DataQuick News reports Southland home sales up, prices down; foreclosures now half the market

La Jolla, CA---Southern California home sales shot up by an unprecedented 65 percent last month from the dismal, record lows of a year ago, when a credit crunch slammed the brakes on home financing. September sales also posted a rare gain over August as price cuts lured more buyers. Foreclosure resales rose to half of all transactions.

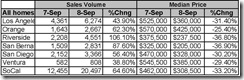

A total of 20,497 new and resale houses and condos closed escrow in the six-county Southland in September, up 5.8 percent from 19,366 in August and up 64.6 percent from 12,455 in September 2007, according to San Diego-based MDA DataQuick, a real estate information service.

Last month's sales were the highest for any month since December 2006 and the year-over-year gain was the highest for any month in DataQuick's statistics, which go back to 1988. However, last month's sales were still the second-lowest for any September since 1996 and were 17 percent below the 20-year sales average for that month.

This September's huge annual sales increase stems from the extraordinarily weak activity in September 2007, when sales were at a record low for that month. The year-ago sales plunged after the credit crunch that struck in August 2007 made "jumbo" mortgages for higher-end homes more expensive and harder to obtain. Sales were already hurting from the subprime mortgage industry meltdown earlier in 2007, which undermined demand for entry-level homes.

"The pitifully low September 2007 sales numbers weren't tough to beat. More impressive was that this September's sales volume bucked the seasonal norm and rose above August. Steep price declines, especially inland, have improved housing affordability quite a bit and may keep sales levels well above the record lows we saw late last year and early this year. It will depend on the severity of this economic downturn," said John Walsh, MDA DataQuick president.

"You have to view last month's sales in the proper context," he cautioned. "They represent escrow closings, which reflect purchase decisions made in mid-to-late summer. That was before the dramatic worsening of the nation's economic crisis in recent weeks. Over the next few weeks our sales data will begin to show how the meltdown in financial markets this fall has impacted housing demand."

Bargain shopping continued to fuel the Southland market last month, with sales typically rising the most in areas where prices have dived and foreclosures have soared.

Fifty percent of all existing homes that closed escrow in September had been foreclosed on at some point in the prior year. That's up from 45.5 percent in August and 12.6 percent in September last year.

At the county level, such foreclosure resales ranged from 36.8 percent of September resales in Orange County to 68.9 percent in Riverside County. In Los Angeles County foreclosure resales were 39.1 percent of all resales; in San Diego 47.3 percent; San Bernardino 63.1 percent and in Ventura County 44.0 percent.

The high level of foreclosure resales helped push the Southland's median sale price down to $308,500 in September, the lowest since it was $305,000 in May 2003. Last month's median was 6.5 percent lower than $330,000 in August and 33.2 percent lower than $462,000 in September 2007. The September median stood 38.9 percent below the peak $505,000 median reached in spring and summer of last year.

Several factors explain the sharp drop in the median price: Regionwide home price depreciation, relatively slow high-end sales, and the rising market share of foreclosure resales, which tend to sell at a discount.

Problems in the jumbo mortgage market continue to undermine high-end home sales. Before the credit crunch hit last August, 40 percent of sales were financed with jumbos, then defined as over $417,000. Last month just 13.2 percent of purchase loans were over $417,000.

MDA DataQuick is a division of MDA Lending Solutions, a subsidiary of Vancouver-based MacDonald Dettwiler and Associates. MDA DataQuick monitors real estate activity nationwide and provides information to consumers, educational institutions, public agencies, lending institutions, title companies and industry analysts.

The typical monthly mortgage payment that Southern California buyers committed themselves to paying was $1,458 last month, down from $1,566 the previous month, and down from $2,198 a year ago. Adjusted for inflation, current payments are 31.9 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle. They are 44.4 percent below the current cycle's peak in June 2006.

Indicators of market distress continue to move in different directions. Foreclosure activity is at or near record levels, financing with adjustable-rate mortgages is near the all-time low, as is financing with multiple mortgages. Down payment sizes and flipping rates are stable, non-owner occupied buying activity appears flat but might be emerging, MDA DataQuick reported.

|