From the San Francisco Chronicle Bay Area homeowners owe more than home's worth

As home values continue to plunge, the real estate valuation service Zillow.com said that 20.76 percent of all homes in the nine-county Bay Area are underwater. The rate is much higher than the national average of 1 in 7 homes, or 14.3 percent. That's because the Bay Area - like most of California - was a classic bubble market, where buyers in recent years paid overinflated prices for homes that now are rapidly losing value in the market downturn.

…Locally, the underwater rate ranged from 7.31 percent in San Francisco to 38.63 percent in Solano County. Nationwide, 16 of the 25 metropolitan areas with the greatest share of "upside-down" homes - another term for the problem - are in California, Zillow said.

…Humphries said Zillow's estimates are "definitely conservative" because they looked only at original purchase mortgages compared with a home's current value. These estimates did not consider cash-out refinances, which have become commonplace and would have made the underwater percentages higher.

"Particularly in the past few years, there has been a tendency for people to use their homes as an ATM, pulling out money in a refinancing," he said. "For homeowners who did that, the amount of equity in their homes is even less than we calculated."

First American CoreLogic, a research firm for the real estate and mortgage market, did a separate survey of negative equity last month that did take refinances into account. It found that 7.5 million homes, representing 18 percent of all U.S. homes with mortgages, are underwater. An additional 2.1 million are close to being upside down.

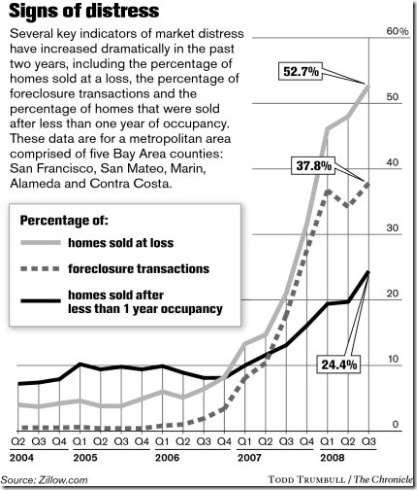

…Zillow also looked at all homes that changed hands in the past 12 months to see how many were sold at a loss. It found that 46.68 of all Bay Area homes were sold for less than the last recorded transaction. The number ranges from 17.2 percent being sold at a loss in San Francisco to 62 percent in Solano County. A significant number of the homes sold at a loss were foreclosures, but they also include short sales - homes sold for less than is owed on the mortgage - and homes where the homeowner had a lot of equity because they had made a big down payment, for instance.

|