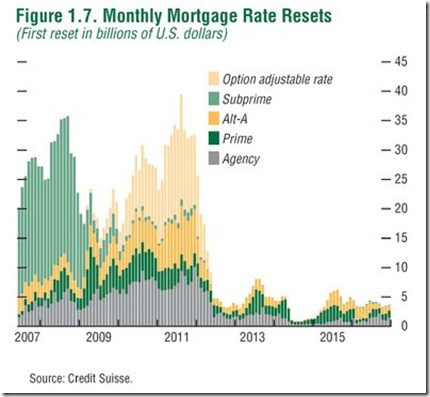

For the most part, the wave of subprime mortgages resetting to higher payments is mostly over. Focus has now turned to the “next wave” of Prime, Alt-A, and Option-Arm resets and defaults. Check out the recent 60 Minutes story on the subject. Here is the classic chart:

Today in Minyanville, Mike Shedlock makes the case that this “time-bomb” has largely been defused: ARMs Reset Problem No Problem at All

I'm taking another look at the yield curve: How it affects pay-option ARMs, interest-only mortgages, and standard 3-1 and 5-1 ARMs.

…Of far more interest to Bernanke than new mortgages, however, are the masses of people in pay-option ARMs, interest-only mortgages, and regular ARMS which are about to reset.

Most adjustable-rate products, including pay-option ARMs, are tied to either 1-year Treasury rates or LIBOR.

…Anyone in a 3-1 ARM or 5-1 ARM about to reset is about to get a huge break. The red (see the charts in his article) squares show the difference. Mortgage relief is coming to everyone who's about to reset, and enormous mortgage relief is coming for those in 3-1 ARMs which are about to reset. Those in 3-1 ARMs may see a drop of as much as 4%, depending on whether or not they had an initial teaser rate. Regardless, everyone appears poised to benefit.

Those in interest-only loans -- tied to 1-month LIBOR, which resets every month -- have been benefiting for quite some time. I'm in that category. My spread is 1.25% over LIBOR, rounded to the nearest one-eighth, which means my interest rate in January will decline to 1.75%. It's currently 3.25% (LIBOR was close to 2.0% this month).

ME: Simply stated, if you have a loan that will be adjusting, odds are great that your payments will drop, not increase.

Free Money

Let's add one final piece to the puzzle. I talked about this in Quantitative Easing American Style: Free Money.

"The Fed is looking at the "benefits" of purchasing longer term Treasury securities. The benefit is to banks who are front-running the trade. Banks can now borrow from the Fed at the discount rate of 0.5%, and invest somewhere out on the yield curve at a higher rate.

"As long as the Fed isn't going to contract credit, banks can hold to maturity and pocket "free money." The odds of Bernanke contracting credit any time soon are essentially zero."

Banks have 2 reasons to buy as many Treasuries as they can:

1. Free money (as long as Bernanke doesn't contract the money supply).

2. Drive yields down to stop foreclosures.…"In addition to a continuing increase in banks' cash assets (to increase their cash ratios against liabilities and loans), we should now see banks' holdings of Treasuries rise significantly. By the mid to late 2010s, expect to find Fed and US member banks to be the largest holders of US Treasury debt by far.

"Just as happened in Japan, those expecting instant and lasting fireworks when the bond bubble explodes are likely to be very disappointed. Low yields can easily be the norm for a long time to come."

Bernanke has every intention of keeping rates as low as he can for as long as he can. With that backdrop, banks will continue to borrow from the Fed at the discount rate and buy as many Treasuries as they can, given that lending makes virtually no sense in an environment of overcapacity, weak demand and rising unemployment.

ME: For this reason, we are likely to see very low short and long-term mortgage rates for a long time to come.

However, this finally puts some light at the end of the housing tunnel, even though it's extremely premature to be looking for any kind of fast recovery. Unemployment is poised to soar in 2009 - and that will offset a great deal of the benefit of falling yields.

MarketWatch reports today Freddie Mac: 30-year fixed mortgage rate at 37-year low

Freddie Mac said Thursday that the 30-year fixed-rate mortgage fell to its lowest average in 37 years. The average rate fell to 5.19% with an average 0.7 point for the week ending Dec. 18, down from 5.47% last week and 6.14% a year ago. "Interest rates for 30-year fixed-rate mortgage rates fell for the seventh consecutive week, moving these rates to the lowest since the survey began in April 1971," said Frank Nothaft, Freddie Mac chief economist, in a statement. "The decline was supported by the Federal Reserve announcement on Dec. 16th, when it cut the federal funds target to a record low and stated it stood ready to expand its purchases of mortgage-related assets as conditions warrant."

Does this mean that these homes won’t go into foreclosure? In some cases, yes. However, most subprime resets only changed payments by small amounts and there were huge numbers of foreclosures. Which, brings up the question: are people walking away from their homes because they can’t afford the payments or because the values have dropped so much?

From what I have seen, most people are walking away because their values have dropped far below what they owe. They realize that it could be years or even a decade before they are back in the black. And, they use the fear of eventually-higher payments as the excuse.

Will this “next wave” of borrowers behave differently? I doubt it. But there is something good about higher payments not forcing families into foreclosure. It would be voluntary.

Eventually, rates will rise again. The flipside of our current deflation is, eventually, inflation again and rates will go up accordingly. Time will tell if Bernanke’s financial engineering will buy enough time for people on the bubble to raise their incomes to compensate for eventually-rising payments, or if we’re simply kicking the foreclosure can down the road.

|