From Standard and Poors

New York, January 27, 2009 – Data through November 2008, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, shows continued broad based declines in the prices of existing single family homes across the United States, with 11 of the 20 metro areas showing record rates of annual decline, and 14 reporting declines in excess of 10% versus November 2007.

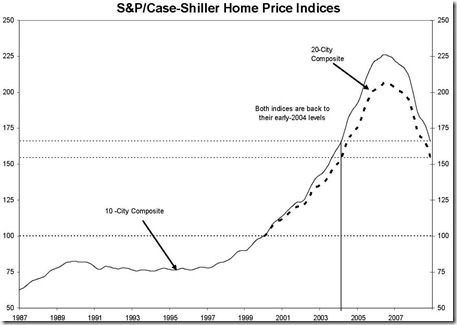

The chart above shows the index levels for the 10-City Composite and 20-City Composite Home Price Indices. It is another illustration of the magnitude of the decline in home prices over the past two years. As of November 2008, average home prices are at similar levels to what they were in the first quarter of 2004. From their peak in mid-2006, the 10-City Composite is down 26.6% and the 20-City Composite is down 25.1%.

Monthly data also continues to show a housing market in decline. All 20 metro areas, and the two composites, posted their third consecutive monthly decline. In addition, eight of the MSAs posted their largest monthly decline on record – Atlanta, Boston, Charlotte, Chicago, Dallas, New York, Portland and Seattle. Although in decline over the past few years, some of these regions have out-performed on a relative basis, when compared to the national average. It is clear, however, that the decline in home prices is affecting all regions regardless of geography or employment opportunities.

Dallas and Denver faired the best in November, in terms of relative year-over-year returns. While in negative territory, their declines remained in low single digits of -3.3% and -4.3%, respectively. It should be noted, Charlotte reported its third consecutive largest monthly decline on record, down 1.9%. Denver and Cleveland were the best reporting markets for the month returning -1.1% and -1.2%, respectively. On a relatively positive note, eight of the 20 metro areas recorded better annual returns compared to last month.

Locally, the San Francisco Price Index now reads 135.28…back to Spring 2002 levels.

|