Some of the best real estate research and analysis that I’ve seen is coming from the Field Check Group. For those of you who are investors, I would recommend that you bookmark this site and/or subscribe to their feed.

To me, the biggest story in real estate is the enormous logjam of foreclosures that’s been building since last fall. I’ve been trying to gather as much information for you as possible.

With Forward Look at Defaults, Foreclosures, Banks and Housing, the Field Check Group delivers another must-read.

The following charts show why some banks may out earn their residential credit losses in Q1. But it is not about what happened in Q1 with the mortgage lender-banks and housing – it’s about going forward. Judging from the hard data over the past several month’s, real estate and mortgage have in fact been the eye of a storm that carries us from the Subprime Implosion to the overall Mortgage and Housing Implosion.

These charts below all come from this report. There is much more information on their website. I recommend reading the whole thing.

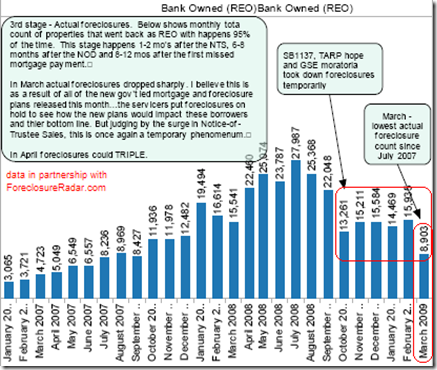

Here is a chart of actual California bank-owned homes (REO).

Here is a chart showing the surge in California Notices of Default. Lenders must wait 120 days after filing this notice before taking the next step in the foreclosure process.

Here is a chart showing the surge in California Notices of Trust Sale. Lenders must then wait at least another 21 days before the actual foreclosure:

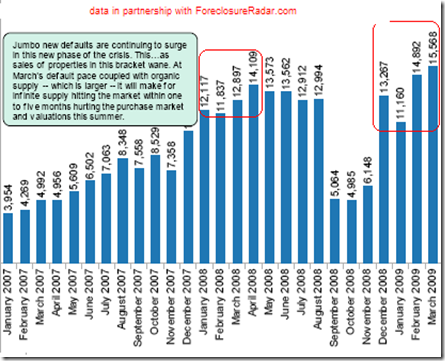

Here is a chart showing the increase in Jumbo foreclosure activity.

|