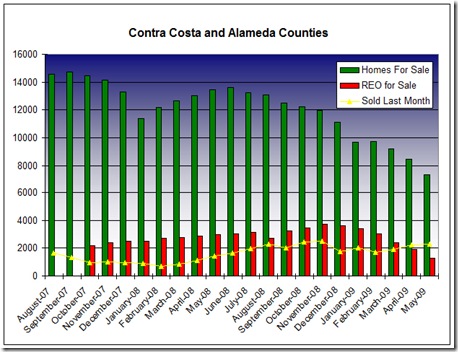

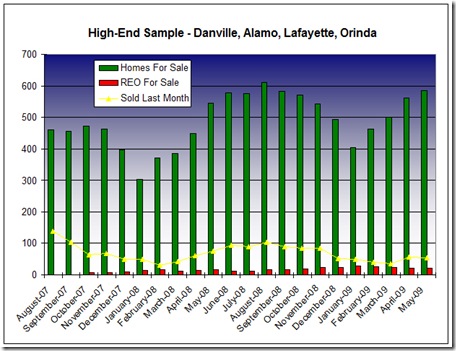

Here is a chart showing housing inventory levels, sales, and REO inventory levels. You can clearly see that the number of REOs for sale begins to drop off in January of 2009….This is the result of foreclosure moratoria that began in the fall.

| 5/1/2009 | MLS Active | MLS Sold Last Month | Months Inventory |

| Alameda County | 3468 | 998 | 3.47 |

| Contra Costa County | 3869 | 1292 | 2.99 |

| Alamo | 137 | 7 | 19.57 |

| Antioch | 322 | 222 | 1.45 |

| Berkeley | 91 | 49 | 1.86 |

| Blackhawk | 80 | 2 | 40.00 |

| Brentwood | 214 | 106 | 2.02 |

| Castro Valley | 138 | 36 | 3.83 |

| Clayton | 52 | 12 | 4.33 |

| Concord | 306 | 139 | 2.20 |

| Danville | 240 | 26 | 9.23 |

| Diablo | 19 | 0 | 0 |

| Discovery Bay | 92 | 24 | 3.83 |

| Dublin | 112 | 36 | 3.11 |

| El Cerrito | 30 | 17 | 1.76 |

| El Sobrante | 35 | 7 | 5.00 |

| Emeryville | 52 | 7 | 7.43 |

| Fremont | 462 | 109 | 4.24 |

| Hayward | 431 | 149 | 2.89 |

| Hercules | 88 | 28 | 3.14 |

| Lafayette | 123 | 12 | 10.25 |

| Livermore | 265 | 72 | 3.68 |

| Martinez | 151 | 32 | 4.72 |

| Moraga | 60 | 7 | 8.57 |

| Newark | 89 | 35 | 2.54 |

| Oakland | 970 | 275 | 3.53 |

| Oakley | 166 | 57 | 2.91 |

| Orinda | 86 | 10 | 8.60 |

| Piedmont | 34 | 6 | 5.67 |

| Pinole | 28 | 16 | 1.75 |

| Pittsburg | 215 | 113 | 1.90 |

| Pleasant Hill | 87 | 14 | 6.21 |

| Pleasanton | 271 | 37 | 7.32 |

| Richmond | 418 | 172 | 2.43 |

| Rodeo | 23 | 12 | 1.92 |

| Rossmoor | 154 | 27 | 5.70 |

| San Leandro | 175 | 67 | 2.61 |

| San Pablo | 115 | 53 | 2.17 |

| San Ramon | 267 | 68 | 3.93 |

| Union City | 169 | 49 | 3.45 |

| Walnut Creek | 254 | 53 | 4.79 |

And, though it may seem like the REO numbers are small, the trend is that they are growing. Six months from now, I would expect to see 100 or more REOs for sale in these areas.

The challenge lies in the trend-line of REO property for sale. The drop-off that began in January was artificially-induced by the government. How high will those red bars get over the next 6 months, now that the foreclosure machines have been turned back on?

|