The San Francisco Chronicle reports More high-end properties sitting on the market

After 14 months on the market and about a $1.2 million price cut, a large, newly built home in the Oakland hills is on the verge of selling, assuming the bank allows it to trade for less than what's due on the loan.

The approximately $950,000 "short sale" is a prominent example of something brokers don't like to talk about, at least not brokers who represent owners: High-end properties are increasingly coming under the sort of pressure once reserved for moderate homes. In fact, as slowing price declines fuel hope that the real estate bottom is near, other signs suggest the worst is on its way for the region's upscale market.

…

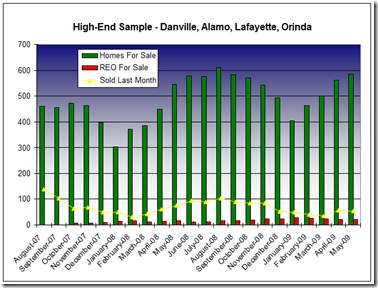

So far, prices for top-end properties aren't declining more or faster than the market as a whole, based on ZIP code information provided by San Diego research firm MDA DataQuick. But strains are becoming evident on that end of the price spectrum.

In the Bay Area, the months of unsold inventory of existing single-family homes priced above $1 million reached 14 months in March, more than double where it stood a year ago, according to the California Association of Realtors. The statistic estimates the time it would take to sell all the homes on the market based on the current rate of transactions.

In contrast, inventory of homes priced below $500,000 fell to just 2.6 months, a nearly 80 percent decline. The same general trends were seen on the state level as well.

…

In the last few months, the well-to-do have watched their businesses unravel, jobs disappear and net worth shrink, said Andrew Jeffery, principal with Cirios Real Estate, a brokerage and research firm in San Francisco.

They're "working through their cushions and you're seeing more distress in the higher-end market, and you're starting to see the beginnings of price deterioration," he said.

…

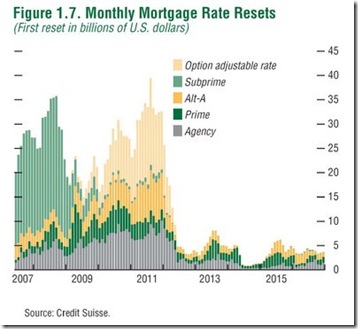

Adjustable-rate mortgages that let borrowers choose how much to pay each month could exacerbate high-end troubles in the months to come as the minimum payments go up, Jeffery said. The loans were originally marketed to the wealthy and, on average, were used to buy more expensive homes than those purchased with subprime mortgages.

Option ARMs initially allow borrowers to pay a minimum that doesn't even cover interest, but once they owe a certain amount above the principal, the monthly obligation is increased - often to a sharply higher level that can lead to defaults and foreclosures. Borrowers are likely to reach those levels in rapidly rising numbers next summer, before climbing to a peak amount of more than $1 trillion in monthly payment adjustments around the end of that year, according to an analysis by Credit Suisse Securities LLC.

"The effect of huge negative equity and unemployment will continue to weigh down on the performance of this sector," said Chandrajit Bhattacharya, mortgage strategist at the Zurich bank.

EYE OF THE STORM

I’ve been using “eye of the storm” to describe the last few months. With delayed foreclosures, a rising stock market, and low interest rates, the last few months have appeared healthy.

This is the classic Credit Suisse chart that the article references:

Take a look at where we are now on this chart. Now factor in that a huge number of would-be-foreclosures from the last half of 2008 have not yet been completed because of delays and moratoria.

HIGH-END VS LOW-END

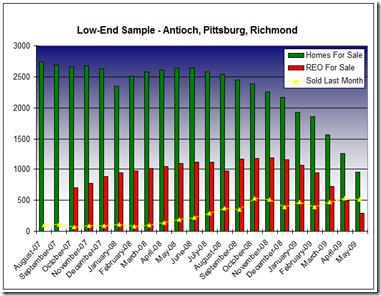

The housing market is segmented, perhaps more by price than by geography. This is partially because of the different loan types in the chart above and partially because wealthy people have more savings and higher credit card limits to delay their day of reckoning.

Compare these 3 charts from May’s East Bay Housing Review

Here is all of Alameda County and Contra Costa County:

Here is the low-end:

Compare those healthy charts with the high-end:

Prices are dictated by supply and demand. Clearly, there will be more pain in the high-end.

|