DataQuick News reports Uptick in Bay Area home sales and median price

La Jolla, CA.----The median price paid for a Bay Area home jumped in May as more expensive homes started to sell again. The overall number of homes sold increased for the ninth month in a row, a real estate information service reported.

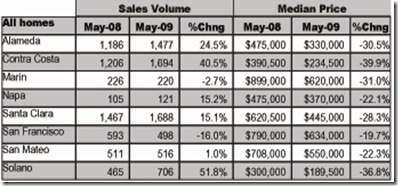

The median price paid for a home in the nine-county region rose to $341,500, up 12.3 percent from $304,000 in April, but down 33.9 percent from $517,000 in May 2008, according to MDA DataQuick of San Diego.

The median’s rise over April marked the second consecutive month-to-month increase. Although last month’s median was 17.8 percent higher than the current cycle’s low of $290,000 in March this year, it was still 48.6 percent below the peak $665,000 median reached in June and July of 2007.

Last month’s $37,500 jump from April was due to a small but noticeable increase in sales of homes financed with home loans for more than $417,000, commonly called “jumbo” mortgages. They accounted for 25.5 percent of the Bay Area’s home sales last month, the highest since 25.8 percent last October. Two years ago it was more than 60 percent. The presence of those high-end sales in the statistics pulled the May median up.

Sales of $800,000-plus existing single-family houses rose to 13.2 percent of all house resales last month, up from 9.8 percent in April and the highest since they were 14.8 percent of sales last October. Sales of sub-$400,000 existing houses dropped to 57.5 percent of May sales, down from 62.2 percent in April and the lowest since 56.5 percent in November.

“We expected this to happen months ago, but better late than never. Some people are going to take this as a sign that the market has bottomed out. Maybe – or maybe not. We won’t know for at least half a year,” said John Walsh, MDA DataQuick president.

“The market has been working its way through the craziness of the ‘loans-gone-wild’ activity of 2005 to 2007. We know a lot about how that is playing out. What we don’t know is how the distress from the recession will ultimately play out in the housing market. The elements are different,” he said.

A total of 7,447 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 4.3 percent from 7,139 in April and up 19.8 percent from 6,216 in May 2008.

The May 2008 sales were the lowest in DataQuick’s statistics, which go back to 1988. May sales have averaged 9,881 and peaked in May 2004 at 13,567 sales.

…

Last month 42.1 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 46.4 percent in April and the lowest since the figure was 41.6 percent last September. A year ago the percentage was 27.7 percent, while the peak was 52.0 percent this February. By county, foreclosure resales ranged last month from 7.7 percent of all resales in San Francisco to 65.1 percent in Solano.

The use of government-insured FHA loans – a common choice among first-time buyers – represented a 24.5 percent of all Bay Area purchase loans in May, down slightly from a record of 26.0 percent in April but up from 7.3 percent a year ago.

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $1,443 last month, up from $1,281 the previous month, and down from $2,458 a year ago. Adjusted for inflation, current payments are 44.6 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle. They are 59.0 percent below the current cycle's peak in July 2007.

Indicators of market distress continue to move in different directions. Foreclosure activity is off its recent peak but remains high by historical standards, while financing with adjustable-rate mortgages is at an all-time low, as is financing with multiple mortgages. Down payment sizes and flipping rates are stable, and non-owner occupied buying activity is above-average in some markets, MDA DataQuick reported.

We knew this was coming…for additional context, read Beware the False Bottom.

I have a problem with the way that these numbers are being portrayed as percentages. The fact that jumbo purchases accounted for 25.5% of sales in May (which pulls up the median price) could mean that high-end sales increased. They did…and that is good.

However, the larger story is that low-end sales are decreasing, largely because of the reduced availability of bank-owned homes. This is the end result of 10-months of moratoria and artificially reduced foreclosures. Fewer low-end sales will change the mix and the median price.

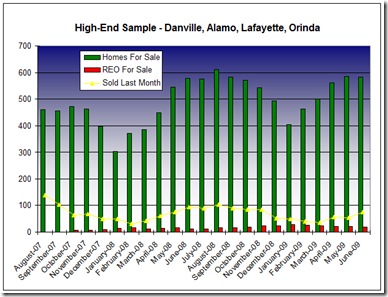

Here are some charts from June’s East Bay Housing Review that show the changing mix.

Notice the yellow line rise…high-end Sales did increase.

Notice the yellow line falling in May and June…low-end sales are falling. Not from a lack of demand, but from a lack of supply. Note that the each month represents data collected on the first day of that month, regarding sales the prior month (the number in June represents homes sold in May, etc.)

Prices aren’t going up. The mix of homes sold has changed as a result of government intervention.

Bottom Callers are everywhere…don’t be fooled.

|