Tehran's Streets Become a Battleground – Time Magazine

German credit crunch deepens – Telegraph, Ambrose Evans-Pritchard

A DIHK survey of German industry, to be released this week and obtained by Der Spiegel, found that over a third of all large companies are still seeing credit conditions tighten further, if they can borrow at all. Terms are now tougher than they were at the height of the global crisis over the winter.

"Financial conditions are getting worse for important sectors of the economy," said the report. It found that borrowing costs had risen for most firms even though the European Central Bank has cut its key interest rate to an historic low of 1pc.

The crucifixion of Latvia – Telegraph, Ambrose Evans-Pritchard

If the purpose of Baltic euro pegs is in part to keep Putin's Russia at bay by locking the region deeper into the EU Project, the strategic gamble has gone badly wrong. It has created a reservoir of Russian irredentism in both Latvia and Estonia that gives Moscow a pretext to intervene at any time. The Baltics are being offered to Putin on a platter.

Latvia is firing a third of its teachers. The welfare state is being dismantled. Pensions for those in work will be cut 70pc. The salaries of doctors, nurses, and police (nota bene) will be cut 20pc. Unemployment has risen from 6pc to 17pc in a year, and is still rising. Jobless benefits for most will run out in the autumn, reducing support to £40 a month. "It is time to take to the streets," said union leader Valdis Keris.

The Clock Is Ticking Away Under Latvia – A Fistful of Euros (This looks a Latvia’s meltdown as partially caused by a generation of not having enough children…interesting stuff)

Essentially, the argument we are developing is that as median ages rise beyond a certain point - 42/43 let’s say - the structural characteristics of an economy change. While younger economies - let’s say with median ages in the 35 - 39 range - are driven by large scale borrowing (on aggregate), domestic consumption surges, and, of course imports and current account deficits to match the domestic savings weaknesses. More elderly societies exhibit higher relative savings levels (Japan, Germany and Sweden would be the classic cases), can no longer rely on domestic consumption to anything like the same extent, and increasingly come to depend on export growth and lending abroad to achieve economic growth. This situation is highly unstable, as we are witnessing now in the Swedish case, since as the consumer booms in the younger societies fail, exports slump and many of the loans go bad. This is not a very satisfactory state of affairs, but it is in fact what is happening. This is the demographic transition we are all part of.

International Demand for U.S. Assets Slowed in April – Bloomberg

International purchases of American financial assets grew more slowly in April as China, Japan and Russia pared demand for Treasuries, underscoring the danger of U.S. reliance on foreigners to finance its fiscal deficit.

The labor market has NOT yet signaled a turning point – Jeffrey Frankel

The length of the average work week fell to its lowest since 1964 ! The graph below shows that, not only did total hours worked decline in May, but the rate of decline (0.7%) was very much in line with the rate of contraction that workers have experienced since September. Hours worked suggests that the hope-inspiring May moderation in the job loss series may have been a monthly aberration. If firms were really gearing up to start hiring workers once again, why would they now be cutting back as strongly as ever on the hours that they ask their existing employees to work? If one factors in falling wages, to compute total weekly earnings, the picture looks still worse. My bottom line: the labor market does not quite yet suggest that the economy has hit bottom.

Stay the Course – The New York Times, Paul Krugman

A few months ago the U.S. economy was in danger of falling into depression. Aggressive monetary policy and deficit spending have, for the time being, averted that danger. And suddenly critics are demanding that we call the whole thing off, and revert to business as usual.

Those demands should be ignored. It’s much too soon to give up on policies that have, at most, pulled us a few inches back from the edge of the abyss.

Fed's Conundrum on Treasury Purchases – The Wall Street Journal

IMF says worst not over – Reuters

Hey New York, Here Comes The Housing Bust – Clusterstock

Credit Card Losses Spike In May – Clusterstock

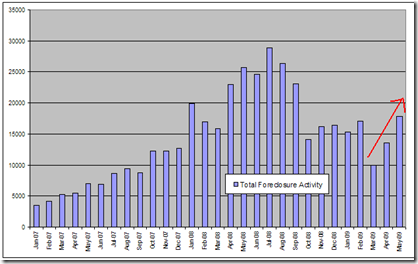

Foreclosure Reality Check: 1.6 Million Foreclosure Filings with 5 Months of Data. California Notice of Defaults and Foreclosures Skyrocketing. – Dr. Housing Bubble

There is a wonderful smell of delusion in the air. As the state marches on to economic Armageddon, there is now a large portion of bottom callers jumping into the market….

Administration calls for financial system overhaul – The Associated Press

The Obama administration says it is committed to overhauling the country's financial rule book by giving the Federal Reserve increased powers to guard against the types of risks that could bring down the entire system.

All large institutions whose failure could threaten the stability of the financial system will be subjected to regulation by the Fed, administration officials said. The proposal also would create a council of regulators with broad coordination responsibility across the financial system.

…

"We had a financial system that was fundamentally too unstable and fragile, and it did a bad job of basic protection of consumers and investors," Geithner said during an economic conference hosted by Time Warner. "Those are things we have to change."

A tale of two markets divided by the conforming-loan limit – The Los Angeles Times

…But at the top of the housing ladder, the move-up market remains at a virtual standstill, stymied by the inability of sellers to attract buyers who can obtain financing at rates close to what first-timers are paying.

Even if the sellers manage to hook a buyer who qualifies for a mortgage under today's super-strict underwriting guidelines, the sellers are probably going to have to invest much of their profit in their next home if they hope to move on.

What we have is a tale of two markets where the dividing line is $417,000, the so-called conforming-loan limit. It's the ceiling on the loans that can be bought by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy loans from primary lenders and package them into securities for sale to investors.

CHART OF THE DAY: California's Unending Housing Problem – Clusterstock

Michael Lewis talks with CNN about the economic crisis and future of Wall Street:

6-14 The Next Foreclosure Wave – The Field Check Group, Mr. Mortgage

Five Things: From Green Shoots to Growth in 60 Seconds? – Minyanville, Kevin Depew

The $3.6 Trillion Leveraged Loan Wall of Debt – Mish

California Foreclosure Moratoriums An Exercise Of Stupidity – Mish

This bill is no more likely to work than a bill declaring poverty to be illegal or the sky to be green.

Home prices will bottom when they bottom, unemployment will bottom when it bottoms, and foreclosures will stop when they stop. Those are simple economic facts.The 90 day extension gives anyone sitting on the edge of walking away as well as those wanting a reduction in principle an incentive to stop paying their mortgage, safe and secure in the fact they cannot be thrown out of their house for another 90 days.

This bill is pure idiocy and will not stop a single foreclosure. Instead, the bill will increase late pays and foreclosures. It's an exercise of sheer stupidity.

California seen missing budget deadline again – Reuters

Barring a miracle, California lawmakers will miss their June 15 deadline for passing a balanced budget -- a staggering challenge with the state facing a $24.3 billion shortfall amid the worst drop in state revenues since the Great Depression.

Observers of the most populous U.S. state's political scene laugh at the idea of a budget deal by Monday.

|