Senate Renews Push to Expand Homebuyer Tax Credit to $15,000 – Bloomberg

June 10 (Bloomberg) -- Lawmakers are pushing to revive legislation in the Senate that would almost double an $8,000 tax credit for first-time homebuyers and expand the program to all borrowers.

Senator Johnny Isakson, a Georgia Republican, plans to introduce a bill today that increases the tax credit to $15,000 and removes income and other restrictions on who can qualify for the credit, according to his spokesman, Sheridan Watson.

The legislation, which is co-sponsored by Senate Banking Committee Chairman Christopher Dodd of Connecticut and other Democrats, would extend the homebuyer credit to multi-family properties that are used as the borrower’s primary residence. It would also eliminate income caps of $75,000 and $150,000 on individuals and couples seeking to claim the credit.

Treasuries Tumble After Auction, Russian Threat to Cut Holdings – Bloomberg

Five Things: Credit Crisis Abating... Debt Crisis Remains – Minyanville, Kevin Depew

Vultures Descend on Mortgage Market – Minyanville, Andrew Jeffrey (partially explaining why pools of distressed homes and mortgages are so hard to find)

…The distressed whole loan market remains largely frozen, as sellers hope for higher prices from buyer's backed by cheap government money. Buyers, meanwhile, remain cautious, since, despite recent "positive" datapoints coming out of the housing market, real-estate prices remain volatile in most markets.

The private market for delinquent mortgages once held the potential for a market-based solution to the country's housing woes. It was no magic bullet, to be sure. But by fostering an environment where private capital could seek out advantageous investments, housing markets would have started down the path towards true price discovery.

As it happened, however, massive government intervention into the market via TARP, the foreclosure moratorium, the PPIP, and other programs forestalled the inevitable, pushing the date of the eventual recovery years into the future.

Mortgage Rates and the Ten Year Yield – Calculated Risk

Fed survey sees signs recession is easing – The Associated Press

A Federal Reserve snapshot of economic conditions issued Wednesday found that five of the Fed's 12 regions said the "downward trend is showing signs of moderating."

In addition, "several" regions said their expectations of future business activity have improved, although they don't see a "substantial increase" through the end of the year. In the last survey, several regions simply noted signs of some stability at low levels.

Altogether the assessments of businesses on the front lines of the economy appeared to be slightly better than those they provided in the previous report issued in mid-April.

Banks Trade TARP for Bonuses, Debauchery, Jets: Jonathan Weil – Bloomberg

Lock up the booze, and hide your wallet. America’s most powerful, too-big-to-fail banks are turning in their TARP money. And you know what that means: It’s party time again on Wall Street.

Revisiting the Merrill acquisition – Reuters, Felix Salmon

California leading growth in nation's green jobs economy, study finds – The Los Angeles Times

Unemployment Claims: Record 6.8 Million Continued Claims – Calculated Risk

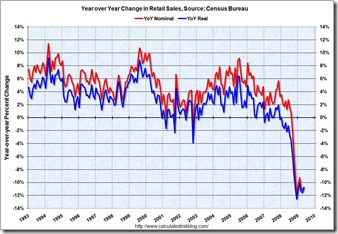

Retail Sales in May: Off 10.8% from May 2008 – Calculated Risk

Debt Fret: The Price of Printing Money – Minyanville, William Fleckenstein

Money-printing has bought us another round of speculation, and while we don't know what other unintended consequences will follow, it looks increasingly likely that this latest round has also "bought" a funding crisis. What it almost surely hasn't created is a self-sustaining recovery.

The 10-Year Treasury Yield Dilemma – Minyanville, James Kostohryz

In my view, this increase in long-dated yields does not signal a serious loss of faith in the credit of the US Treasury, nor does it signal any sort of serious future inflation. Rather, this increase in yield is a function of a technical supply and demand phenomenon – plain and simple.

US family stumped: How did Christmas photo get in life-size ad in Czech Republic store? – Breitbart News

Mortgage Market Remains Solidly Frozen – Mish

What now Big Ben? You've already blown over a third of your $1.25 trillion commitment and all you have to show for it is more garbage on your balance sheet and a locked up refi market.

One thing is clear, Ben Bernanke and the Fed have lost control of the mortgage market (not that the Fed was ever in control in the first place). They weren't. It was all an illusion.

Option ARMs Threaten Housing Rebound as Resets Peak – Bloomberg

OptionARM Homebuyers See Monthly Payments Go From $95 To $3,500 – Clusterstock

Foreclosure activity see-sawing – The Contra Costa Times

Nationwide, foreclosure activity increased by 18 percent on a year-to-year basis while statewide there was a 23 percent increase.

"May foreclosure activity was the third highest month on record, and marked the third straight month where the total number of foreclosure filings exceeded 300,000 - a first in the history of our report," James J. Saccacio, RealtyTrac's chief executive officer said in a statement.

Bruce Norrris, founder of The Norris Group, a Riverside-based real investment firm, expects the Bay Area to continuing seeing more foreclosures in the coming months, despite the June 15 rollout of a new state law that is intended to stem the foreclosure tide. The law requires lenders to delay foreclosure proceedings for 90 days on owner-occupied homes purchased between Jan 1. 2003, and Jan. 1, 2008, in cases where the financial institution does not offer a loan modification program to borrowers.

"I don't think it's going to be a real solution," said Norris, adding that many lenders already have loan modification programs in place. "I think in three months Northern California is going to be inundated with foreclosures," he said.

|