Foreclosure Goes Upscale – Businessweek

When will this second wave of foreclosures crest? David Crowe, chief economist of the National Association of Home Builders, doesn't see the peak coming until 2011, later than most other experts predict. Foreclosures typically top out after unemployment does, and Crowe doesn't expect that to occur until late this year. After that, Crowe says, more people will lose their homes because of upward resets on adjustable-rate mortgages. Credit Suisse says mid-2010 is the peak for scheduled resets, and resets will stay high well into 2012. While most of the subprime loans issued during the boom years have been washed out by now, there are still about half a trillion dollars' worth of option ARMs, which allow borrowers to add unpaid interest to the principal they owe. There's an even more alarming $2.5 trillion in "alt-A" loans, which are between prime and subprime and include a big chunk of the mortgages that required little or no proof of income or assets. Most of these loans were issued to people with relatively good credit who were buying more expensive homes.

The Coming Currency Crisis – Minyanville, Jeffrey Cooper

Given that the Fed was born on the cusp of 1913-1914, does that mean that this July will choreograph momentous change as well? Will the red shoots from the second half of 2008 sprout Venus Fly Traps for the bulls in July 2008? Will the steroids of stimulus strike out and the sultans of swing sell out into quarter end? Will the seeds of chaos for the dollar sown in 2008 take root a year later this July?

Homebuyers Crash Into Appraisal Roadblock – Minyanville, Andrew Jeffrey

Median home prices drop below 1989 levels in some parts of Southland – The Los Angeles Times

In parts of Southern California, the housing crash has upended a basic tenet of the American dream: that home values always increase over the long term.

Properties in several areas are selling for less than they did 20 years ago, and that's not even counting the effects of inflation.

It will take Wells Fargo longer to repay TARP – The San Francisco Chronicle

Remember when Wells Fargo & Co. had to be dragged kicking and screaming into taking TARP money, said it couldn't wait to pay back the $25 million, and Chairman Richard Kovacevich called the government's stress test asinine? The San Francisco bank sang a different tune on Tuesday when it explained why it wasn't one of the 10 major U.S. banks repaying the TARP loans.

Survey: Venture capital firms look outside U.S. – The San Francisco Chronicle

Only 17 percent of venture capitalists expect to increase their investments in the United States over the next three years, while more than half are investing in companies outside the country, according to a new survey.

Weak Hiring and the Jobless Recovery – Calculated Risk

May Jobs Report Not So Great After All – Clusterstock

Welcome to California, Home of the Highest Taxes in the Nation – Mish

Home Prices Have Hit Bottom – BusinessWeek

I’m telling you it’s true. The slump is over. Don’t believe what you read about a second wave of foreclosures coming and things getting worse. In Southern California, where I live, sales are coming back in a big way.

Treasuries Decline as Russia May Pare Holdings of U.S. Debt – Bloomberg

Commercial Real Estate: A Ticking Time Bomb for Banks? – Minyanville, Minyan Peter

Dumped mattress lands cash in trash in Israel – Breitbart News

A stash of cash landed in the trash when a woman in Israel dumped her mother's mattress not knowing it was stuffed with the equivalent of about one million dollars.

Israeli media reported that the 40-year-old woman showed up at a garbage dump in a panic on Tuesday, looking for the valuable bedding.

She had bought a new mattress for her mother and, wanting the gift to be a surprise, threw away the old one. She then found out the decades-old mattress contained her mother's life savings.

America’s Sea of Red Ink Was Years in the Making – The New York Times

The story of today’s deficits starts in January 2001, as President Bill Clinton was leaving office. The Congressional Budget Office estimated then that the government would run an average annual surplus of more than $800 billion a year from 2009 to 2012. Today, the government is expected to run a $1.2 trillion annual deficit in those years.

You can think of that roughly $2 trillion swing as coming from four broad categories: the business cycle, President George W. Bush’s policies, policies from the Bush years that are scheduled to expire but that Mr. Obama has chosen to extend, and new policies proposed by Mr. Obama…

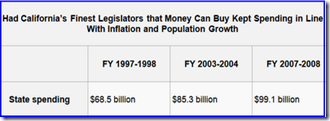

|