Five Things: We Have the Means; the Motive Is Missing – Minyanville, Kevin Depew

Going back to 1934, whenever the Federal Reserve has made credit available the world has accepted it. While it is true, as those anticipating hyperinflation argue, the Fed and global central banks are making record amounts of credit available, that is only one side of the credit equation...

First American CoreLogic: Housing Prices Off 10.2% – HousingWire

Housing prices across the nation on average lost a little more than 10% in April when compared to prices one year earlier, according to research from First American CoreLogic, which also said its LoanPerformance Home Price Index saw the pace of price declines slow to their lowest levels this year. Home price declines have been abating throughout the year, peaking at -11.9% during January 2009, according to the firm — the 10.2% decline posted in April represents the smallest year-over-year decline recorded this year thus far.

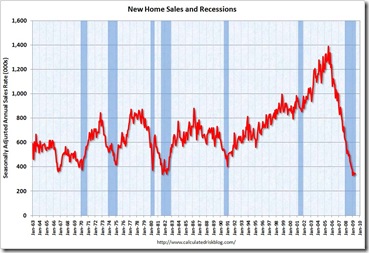

New Home Sales: Record Low for May – Calculated Risk

Retirees Kidnap And Torture Financial Advisor Who Lost Them Money – Clusterstock

CHART OF THE DAY: You Call This A Housing Rebound? – Clusterstock

Housing, unemployment woes leave movers shaken – The San Francisco Chronicle

Sinking home prices and a weak job market have forced normally restless Americans to stay put in an uncharacteristic shift that has, among other things, clobbered the moving industry.

"Property values have dropped so much, people can't pick up and move the way they used to," said Michael Hicks, a demographer at Ball State University in Indiana who has tracked the nationwide slowdown using data from several sources, including moving companies.

That industry data mirrors a Census Bureau report that looked at moves in 2008, said William Frey, a demographer at the Brookings Institution in Washington, D.C.

"The annual migration rate has gone way down to historic low levels," Frey said. "This includes long-distance moves and moving across town."

During the 1950s and 1960s, Frey said, as many as 20 percent of Americans moved in any given year. Mobility rates slowed to 15 percent to 16 percent during the 1990s. But in 2008, only 11.9 percent of Americans moved, he said.

Desperate Maine lobstermen cut out dealers – The Associated Press

Lobsterman Greg Turner keeps a sandwich-board sign at the end of his driveway that advertises fresh lobster for sale from his garage, an attempt to claw for a few extra dollars by reaching buyers directly.

With prices stuck on low and expected to fall further this summer, he's skirting the traditional sales route by cutting out the dealers who usually sell lobster catches to retailers, restaurants, processors and other buyers.

Prices for lobster plunged last year to levels not seen in 20 years, leading Turner and a growing number of other lobstermen to sell from the backs of pickup trucks, from garages, and even on Craigslist. By going directly to consumers, lobstermen say they can make roughly $1 more per pound than what they get from lobster dealers.

"No one wants to do it," said Turner, a longtime fisherman whose garage is a bare-bones retail operation with cold-water holding tanks, a scale and a cash register. "If the price hadn't gone into the toilet, I wouldn't have done this in the first place."

Walnut Creek realty heating up – The Contra Costa Times

Commercial realty investors — with the most recent deal coming a few days ago — have snapped up choice sites in downtown Walnut Creek. Yul Kwon, who won "Survivor: Cook Islands," this month opened a Red Mango frozen yogurt store in the city's urban core.

"Downtown Walnut Creek is one of the best retail locations in the entire Bay Area," Kwon said. "Opening a store in this economy is a frightening proposition. This recession has been hard for everyone. But downtown Walnut Creek is poised to grow when the economy rebounds."

Property investors who recently bought an array of downtown parcels also exude confidence about the region's future. But they also see an opportunity to buy promising properties on the heels of a softening of prices for commercial properties downtown.

Market watchers believe prices are down 10 percent — maybe even more — for some retail and office parcels. At the height of the market a few years ago, some downtown retail buildings sold for $500 a square foot. Some of the recent sales are more in the $400-a-square-foot range.

10-year look ahead in housing – The Contra Costa Times

There are plenty of Web sites out there that will tell you how much a home is worth right now. But now a Pleasanton-based company has launched www.smartzip.com, a free Web site designed to help investors and everyday home buyers assess the future value of homes for sale in California and Florida, two areas of the country hit hardest by the foreclosure crisis.

Millionaires' Club Shrank at Record Rate in 2008, Merrill Says – Bloomberg News

Seasonal Homes Sales Trend – The Big Picture

$800 a month in rent, or $800k to own! - Burbed

Real City of Genius: Case Study of the Middle Priced Los Angeles Housing Market. Pasadena in Focus. The Alt-A Mortgage Debacle Gearing Up. – Dr. Housing Bubble

Mortgage Bankers Slash 2009 Forecasts – Realty Check with Diana Olick

Today the Mortgage Bankers Association put out a revision in its 2009 originations forecast. A big revision. A $700 billion revision. “$84 billion of the drop is due to lower purchase originations and the rest is due to lower rate/term refinances and very low volumes in the Fannie Mae and Freddie Mac Home Affordable Refinance Program (HARP).” That’s big too.

|