In the beginning that this was a “subprime” problem. Marginal buyers leveraged themselves into homes they couldn’t really afford, and then lost them as payment adjusted. These were the canaries in our very deep and complex mine of global finance.

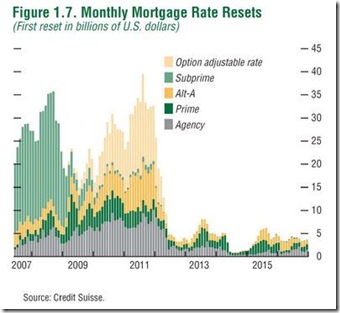

Payment changes were highlighted early on as the prime culprit. Certainly, payment shock for the least-qualified played a role in getting us where we are today, but that role may be less then previously believed.

First of all, Government-induced low rates have eliminated (for now) the impact of mass payment changes. For many, payments have actually gone down.

Second, mass payment recasting (ex: a payment change for an option-arm loan) hasn’t really started yet. We’re another year or more away.

Economists assumed that homeowners would do everything that they could to keep their homes. Policy so far has been focused on two main points:

- Keep rates low to help people refinance from adjustable to fixed mortgages, reduce payment-adjustment shock, and to encourage new buyers into the market.

- Modify existing loans to help people afford to keep their homes, even if it meant deferring payments or extending their loan terms.

Current Policies Have Failed

Policymakers rely on recommendations from economists. Economists rely on models. Models, apparently, believed that real estate prices could go up indefinitely, at a faster pace than incomes. Neither the economists nor the policymakers had the common sense to ask “What if these models are wrong?”

Models cannot take into account geo-political conflict, currency collapse, Iceland or Latvia, Honduras. They can’t account for declining tax revenues or mass bankruptcies. They can’t account for changing social attitudes towards luxury goods and debt. And, they didn’t expect homeowners to actually want to walk away from their homes.

In the Wall Street Journal, Stan Liebowitz presents New Evidence on the Foreclosure Crisis - Zero money down, not subprime loans, led to the mortgage meltdown.

The analysis indicates that, by far, the most important factor related to foreclosures is the extent to which the homeowner now has or ever had positive equity in a home. The accompanying figure shows how important negative equity or a low Loan-To-Value ratio is in explaining foreclosures (homes in foreclosure during December of 2008 generally entered foreclosure in the second half of 2008). A simple statistic can help make the point: although only 12% of homes had negative equity, they comprised 47% of all foreclosures.

Further, because it is difficult to account for second mortgages in this data, my measurement of negative equity and its impact on foreclosures is probably too low, making my estimates conservative.

What about upward resets in mortgage interest rates? I found that interest rate resets did not measurably increase foreclosures until the reset was greater than four percentage points. Only 8% of foreclosures had an interest rate increase of that much. Thus the overall impact of upward interest rate resets is much smaller than the impact from equity.

To be sure, many other variables -- such as FICO scores (a measure of creditworthiness), income levels, unemployment rates and whether the house was purchased for speculation -- are related to foreclosures. But liar loans and loans with initial teaser rates had virtually no impact on foreclosures, in spite of the dubious nature of these financial instruments.

My thoughts: I would agree for reasons discussed above that these liar/teaser loans have had little impact. However, if interested rates were not artificially manipulated lower, their impact would be much greater. For some, temporarily-low rates may only serve to delay the eventual foreclosure.

Instead, the important factor is whether or not the homeowner currently has or ever had an important financial stake in the house. Yet merely because an individual has a home with negative equity does not imply that he or she cannot make mortgage payments so much as it implies that the borrower is more willing to walk away from the loan.

The difference in policy implications is enormous: A significant reduction in foreclosures will happen when and only when housing prices stop falling and unemployment stops rising (see chart nearby).

My thoughts: House prices will stop falling and unemployment will stop rising when the bulk of the foreclosures are behind us. If people feel that their homes are likely to appreciate in value, then they are more likely to stick it out.

Although the government is throwing money -- almost $2 trillion and counting -- at the mortgage markets with the intent of stabilizing house prices, its methods are poorly targeted. While Federal Reserve actions have succeeded in reducing mortgage interest rates, low interest rates induce refinancings more than they do home purchases.

…

Other government policies are likely to be even less effective in reducing foreclosures. The Obama administration's "Making Homes Affordable" plan focuses on having the government help lower obligation ratios (the share of income devoted to house payments) down to 31% from levels somewhat above 38%. But my analysis finds that mortgages having such obligation ratios at closing did not later experience high foreclosure rates. This suggests that reducing these ratios is not likely to significantly improve the foreclosure problem.

Understanding the causes of the foreclosure explosion is required if we wish to avoid a replay of recent painful events. The suggestions being put forward by the administration and most media outlets -- more stringent regulation of subprime lenders -- would not have prevented the mortgage meltdown regardless of their merit otherwise.

My thoughts: Nothing would have prevented the housing bubble from bursting other than it not having been inflated in the first place.

Rather, stronger underwriting standards are needed -- especially a requirement for relatively high down payments. If substantial down payments had been required, the housing price bubble would certainly have been smaller, if it occurred at all, and the incidence of negative equity would have been much smaller even as home prices fell. A further beneficial regulation would be a strengthening, or at least clarifying at a national level, of the recourse that mortgage lenders have if a borrower defaults. Many defaults could be mitigated if homeowners with financial resources know they can't just walk away.

My thoughts: Clarity of the legal process is always good. But people will still walk away because it becomes the economically prudent thing to do.

On The Edge of a Cliff?

Much has been made of the disconnect between High-End and Low-End markets, with the low-end suffering the greater percentage drops so far. Now, there is much debate over the fate of the High-End.

The disconnect is real. Here is the East San Francisco Bay, Low-End areas are off 60-70%, while some High-End areas may only be 25-30% below their peak.

Over the last 18 months or so, sales velocity has shifted. Low-End areas are booming, while High-End areas are seeing very few transactions. Price follows volume…so, in the short term at least, we can see what communities are falling and which could be beginning to stabilize.

Here are two sample charts from July’s East Bay Housing Review.

If Stan Liebowitz is correct, then the classic mortgage reset charts that have been popular on this site and many others, carry less weight moving forward.

Negative equity will induce some High-End homeowners to walk away, pushing down prices and creating greater negative equity for even more borrowers. As it becomes more common, walking away will become more socially acceptable. If that happens, then…look out below.

Mass Principal Reductions

If one is going to attempt to “solve” this problem, then it is abundantly clear that The Powers That Be must come up with a plan to reduce the principal balances owed on homes in trouble. (Of course, then just about every homeowner would suddenly find themselves distressed and needing a reduction.)

The problem we have is defining the “problem.”

Falling house prices aren’t the problem, they are the solution.

Foreclosures aren’t the problem, they are the solution.

Bankruptcies aren’t the problem, they are the solution.

Excessive debt is the problem and the only solution is to destroy it.

If The Powers That Be feel the need to regulate this debt-destruction process to make it orderly and defined…to avoid the chaos of a global financial meltdown…then this is the next logical step for them to take.

![high_end_july_1_copy[4] high_end_july_1_copy[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhC4KY2VEMDJZnpwuoGY95gtc9nI-Rxp-9DYwz1yf4-BJMTP43KFyg0tPC8hKXUxNSlVXPKZhxUq7Awv_dIA_E2Qb0i5eIYOPJw-cvCAYRMB-lsJ9eqSEagIob7JsjU20mhCjJwvByxEHDp/?imgmax=800)

![lowend_july_1[5] lowend_july_1[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjt-qRzIzLvd7PbHBM_-rCRVVFBK6EaHQas0ieJMk0UzkPUFqJv0_wKXstNqQEicNp0OaJH9WB86yNtrjYltpNHNi9u9N7MvfE60E2BCberwvgZTLbogOyodNZVQX18n1wNgOVq23YiNvWT/?imgmax=800)

|