The San Francisco Chronicle has a fantastic article Banks aren't reselling many foreclosed homes

A vast "shadow inventory" of foreclosed homes that banks are holding off the market could wreak havoc with the already battered real estate sector, industry observers say.

Lenders nationwide are sitting on hundreds of thousands of foreclosed homes that they have not resold or listed for sale, according to numerous data sources. And foreclosures, which banks unload at fire-sale prices, are a major factor driving home values down.

"We believe there are in the neighborhood of 600,000 properties nationwide that banks have repossessed but not put on the market," said Rick Sharga, vice president of RealtyTrac, which compiles nationwide statistics on foreclosures. "California probably represents 80,000 of those homes. It could be disastrous if the banks suddenly flooded the market with those distressed properties. You'd have further depreciation and carnage."

In a recent study, RealtyTrac compared its database of bank-repossessed homes to MLS listings of for-sale homes in four states, including California. It found a significant disparity - only 30 percent of the foreclosures were listed for sale in the Multiple Listing Service. The remainder is known in the industry as "shadow inventory."

"There is a real danger that there is much more (foreclosure) inventory than we are measuring," said Celia Chen, director of housing economics at Moody's Economy.com in Pennsylvania. "Eventually those homes will have to be dealt with. If they're all put on the market, that will add more inventory to an already bloated market and drive down home prices even more."

There are two parts to this…this part deals with the homes that have actually been foreclosed on and that many of those homes have not been put up for sale yet.

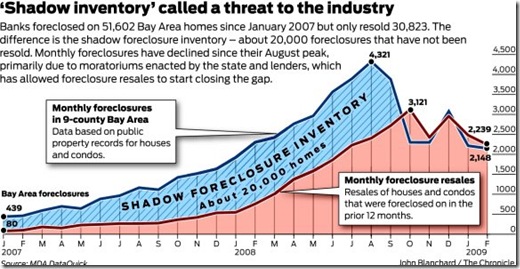

…For the 26 months from January 2007 through February 2009, banks repossessed 51,602 homes and condos in the nine-county Bay Area, according to DataQuick. Yet in the same period, only 30,823 foreclosures were resold, leaving about 20,000 bank repos unaccounted for.

…"Foreclosure numbers are artificially depressed," said CEO Sean O'Toole. He puts California's shadow inventory at about 100,000 homes.

Again, this is part 1…the homes that were actually foreclosed upon. This has nothing to do with moratoriums.

…Most observers say the recent fall-off in foreclosures came because California and many banks implemented foreclosure moratoriums in the fall, not because the problem has diminished.

…So why aren't banks selling off their foreclosures?

Observers say several factors are at work.

-- The "pig in the python": Digesting all those foreclosures takes awhile. It's time-consuming to get a home vacant, clean and ready for sale. "The system is overwhelmed by the volume," Sharga said. "In a normal market, there are 160,000 (foreclosures for sale nationwide) over the course of a year. Right now, there are about 80,000 every month."

-- Accounting sleight-of-hand: Lenders could be deferring sales to put off having to acknowledge the actual extent of their loss. "With banks in the stress they're in, I don't think they're anxious to show losses in assets on their balance sheets," O'Toole said.

-- Slowing the free-fall: Banks might be strategically holding back some foreclosures so prices don't fall as fast. "They want to be careful about not releasing them too quickly so they don't drive prices down and hurt the values," O'Toole said.

Besides the shadow foreclosures, yet another wave of distressed properties is in the pipeline. These are homes with delinquent payments for which the banks appear to be prolonging the foreclosure process. Some of that could be because they're negotiating with homeowners about loan modifications or other ways to keep them in the home. But banks also could be deliberately foot-dragging for the same three reasons listed above.

Here is part 2. Ever since September 1st or so of 2008, actual foreclosures have fallen off of a cliff. There is a huge logjam. And, with Fannie and Freddie’s recent announcement, the logjam may be coming undone.

|