From Standard & Poors The Pace of Home Price Declines Moderate in April According to the S&P/Case-Shiller Home Price Indices

…“The pace of decline in residential real estate slowed in April,” says David M. Blitzer, Chairman of the Index Committee at Standard & Poor’s. “In addition to the 10-City and 20-City Composites, 13 of the 20 metro areas also saw improvement in their annual return compared to that of March. Furthermore, every metro area, except for Charlotte, recorded an improvement in monthly returns over March. While one month’s data cannot determine if a turnaround has begun; it seems that some stabilization may be appearing in some of the regions. We are entering the seasonally strong period in the housing market, so it will take some time to determine if a recovery is really here.

“The stock market bottomed in March and measures of consumer confidence have turned upward. This report shows that these better spirits are also appearing in the housing market” Mr. Blitzer commented.

Sounds like it’s all peaches and sunshine from here…

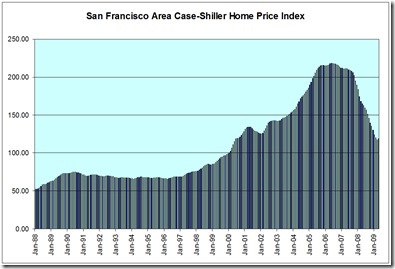

The San Francisco Area Home Price Index actually rose from 117.74 in March to 118.46 in April. Joining San Francisco with small increases were Denver, Washington DC, Atlanta, Dallas, and Seattle. Time will tell if this is a real bottom forming or simply the false bottom we’ve been talking about.

Barry Ritholtz comments at The Big Picture Case Shiller Index Falls 18%

Don’t break out the champagne, just yet.

The reduced collapse speed (another one of those famed 2nd derivatives) is primarily a function of foreclosure moratoriums. The overall trend in housing remains weak, with soft demand, excess inventory and heavily indebted consumer unlikely to effect a V-recovery.

That is before we consider the ongoing NFP job losses, which have been contributing to additional foreclosures.

And once the various government stimuli gets withdrawn — very low rates, $8,000 first-time home buyer tax credit — we can expect even these weak reports to turn south.

In a separate post, he shows an the classic Case-Shiller chart updated with projections:

No over-correction?

|